Presented by SBS Retirement Consultants

December was a mixed month for markets due to a late month sell-off. Despite the volatility to end the period, 2025 was still a strong year for investors, as most major stock indices notched double-digit returns for the year. Looking ahead, continued economic growth and market appreciation are expected throughout 2026.

Quick Hits:

1. Beyond the Headlines: Mixed December Caps Off Strong Year

2. Falling Interest Rates: Stocks and Bonds Benefit

3. Economic Report Updates: Solid Growth with Potential Risks

4. Looking Ahead: Continued Growth and Appreciation

Beyond the Headlines: Mixed December Caps Off Strong Year

December closed out 2025 on a muted note for U.S. stocks. The Nasdaq slipped modestly, while the S&P 500 and Dow Jones Industrial Average posted small gains. Despite this quiet finish, the full-year picture was far more encouraging: all three major U.S. indices delivered double-digit returns, supported by resilient corporate earnings and easing financial conditions.

The S&P 500 gained 0.06 percent in December, 2.66 percent in the fourth quarter, and 17.88 percent for the year. The Dow was up 0.92 percent in December, 4.03 percent for the quarter, and 14.92 percent for the year. Finally, the Nasdaq Composite lost 0.47 percent in December but gained 2.72 percent for the quarter and 21.14 percent for the year.

These strong results were driven by healthy fundamentals. Earnings growth remained impressively resilient in 2025, and this is expected to continue into 2026. Average earnings growth for the S&P 500 was more than 15 percent in the third quarter, which was more than double analyst estimates. Technical factors were supportive as well, with all three indices finishing the year well above their respective 200-day moving averages.

International stocks outperformed their domestic counterparts for the month and year. Developed and emerging markets both rallied in December, capping off a strong year for international investors. The MSCI EAFE Index gained 3.00 percent for the month, 4.86 percent for the quarter, and an impressive 31.22 percent for the year. The MSCI Emerging Markets Index did even better, up 3.02 percent for the month, 4.78 percent for the quarter, and 34.36 percent for the year. Foreign stocks were supported by a weaker dollar and renewed investor appetite for international companies throughout the year, as well as solid technicals.

Falling Interest Rates: Stocks and Bonds Benefit

Fixed income investors enjoyed a strong year as falling interest rates boosted bond prices. The Bloomberg U.S. Aggregate Bond Index fell 0.15 percent in December but gained 1.10 percent in the fourth quarter and a strong 7.30 percent for the year.

Even high yield did well, driven by tightening credit spreads. The Bloomberg U.S. Corporate High Yield Index gained 0.57 percent in December, 1.31 percent in the quarter, and a strong 8.62 percent for the full year.

The 10-year Treasury yield dropped from 4.57 percent at the start of the year to 4.17 percent by year-end, while short-term rates followed suit. This falling rate environment was driven in part by three Federal Reserve rate cuts in the final months of the year, as policymakers shifted focus toward supporting employment amid signs of labor market cooling. Looking forward, markets expect to see between two to three additional rate cuts in 2026; however, the timing on any potential cuts remains uncertain.

Economic Report Updates: Solid Growth with Potential Risks

We continued to receive sporadic economic data releases in December as multiple federal agencies struggled to resume their regular schedule of updates following the conclusion of the federal government shutdown earlier in the fall. The updates that we did receive largely showed signs of continued economic growth.

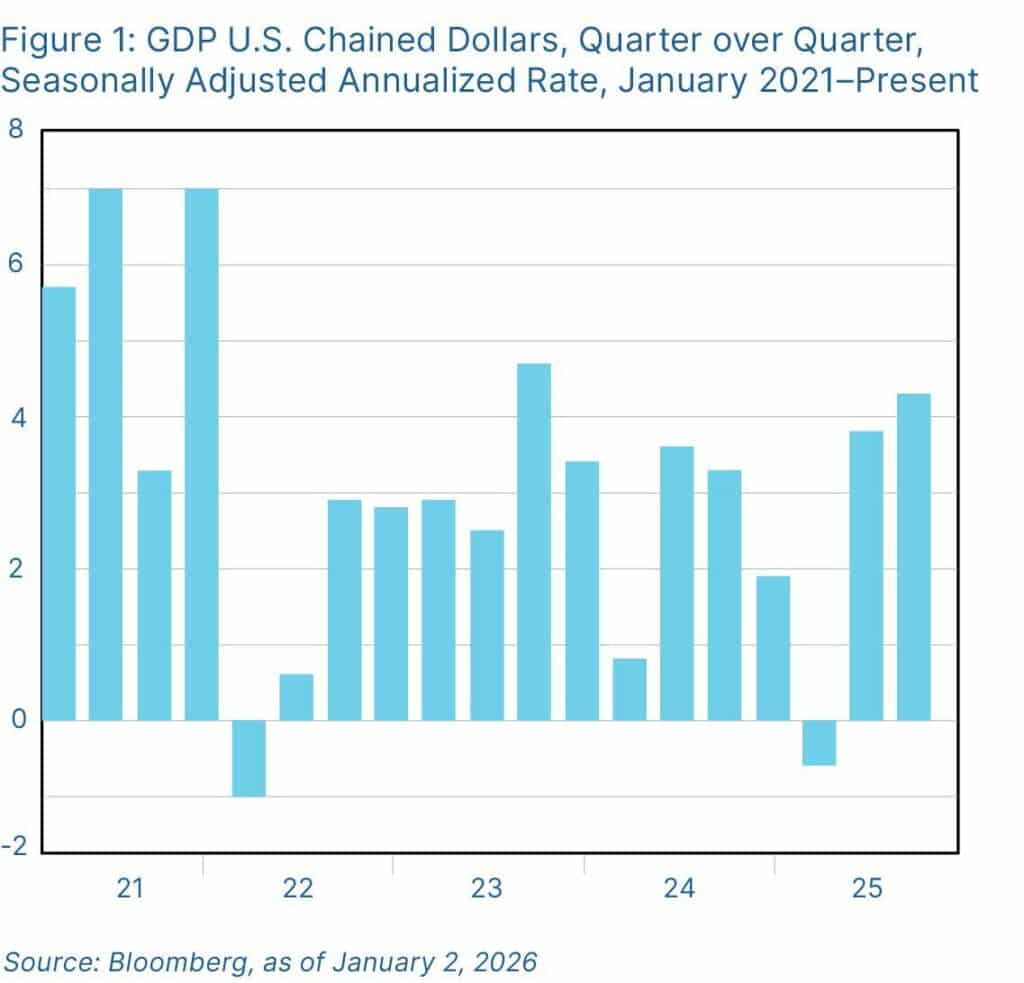

The highlight was the first look at GDP growth in the third quarter, which came in well above expectations. As seen in Figure 1, the 4.3 percent annualized growth rate marked the best quarter for economic growth in more than two years. Encouragingly, personal consumption growth was a major driver of overall economic growth in the quarter. Despite the strong headline growth, however, there were signs of potential risks ahead. Hiring slowed notably in the second half of the year, prompting the Fed’s policy pivot. A healthy labor market is critical for sustaining consumer demand, so this trend bears close monitoring. While recent data releases were delayed and, in some cases, even canceled due to government shutdown disruptions, the partial updates confirm a largely cooling employment backdrop.

Looking Ahead: Continued Growth and Appreciation

As we enter into 2026, the outlook remains constructive with caveats. Continued earnings growth and accommodative monetary policy should support markets into the new year, with the momentum from 2025 expected to carry over. With that being said, there are real risks that should be acknowledged and monitored.

Domestically, political uncertainty remains the most pressing risk. As we saw during the recent government shutdown, policy decisions from Washington have the potential to impact markets and the economy in uncertain ways. While still a long way out, the midterm elections in November are expected to serve as a potential source for further political uncertainty throughout the year. And, of course, there are international risks as well, including the ongoing conflicts in Ukraine and the Middle East.

On the whole, however, we remain in a pretty good place as we step into the new year. Market fundamentals have shown impressive growth, driven by a supportive economic backdrop and easing monetary policy. While we may face short-term setbacks along the way, the most likely path forward in our view is for continued economic growth and positive market returns.

Given the outlook, a well-diversified portfolio that aligns investor goals with timelines and risk tolerance remains the best path forward for most investors. If concerns remain, you should speak with your financial advisor to go over your financial plans and goals.

Disclosure: This material is intended for informational/educational purposes only and should not be construed as investment advice, a solicitation, or a recommendation to buy or sell any security or investment product. Please contact your financial professional for more information specific to your situation.

Certain sections of this commentary contain forward-looking statements based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets. All indices are unmanaged and investors cannot invest directly into an index. The Dow Jones Industrial Average is a price-weighted average of 30 actively traded blue-chip stocks. The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners. The Bloomberg Aggregate Bond Index is an unmanaged market value-weighted index representing securities that are SEC-registered, taxable, and dollar-denominated. It covers the U.S. investment-grade fixed-rate bond market, with index components for a combination of the Bloomberg government and corporate securities, mortgage-backed pass-through securities, and asset-backed securities. The Bloomberg U.S. Corporate High Yield Index covers the USD-denominated, non-investment-grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below. One basis point (bp) is equal to 1/100th of 1 percent, or 0.01 percent.

Authored by Chris Fasciano, vice president, chief market strategist, and Sam Millette, director, fixed income, at Commonwealth Financial Network®. ©2026 Commonwealth Financial Network®